G’day Surfers – didn’t see that one coming.

Yesterday’s Report

Though markets were closed in both Tokyo & NY, those that DID turn up for work, were in the mood only to sell EUR/USD. I was expecting a very quiet trading day but it would appear the better than expected US Unemployment number has dampened recent enthusiasm for EURO, the cross having eased 135 pips since Friday’s Employment figures were released. A bounce off the day’s low of 1.2937 saw EURO close @ 1.2967. StP strategy dictates we take the day off with NY Traders so no trades for us.

Technical Analysis

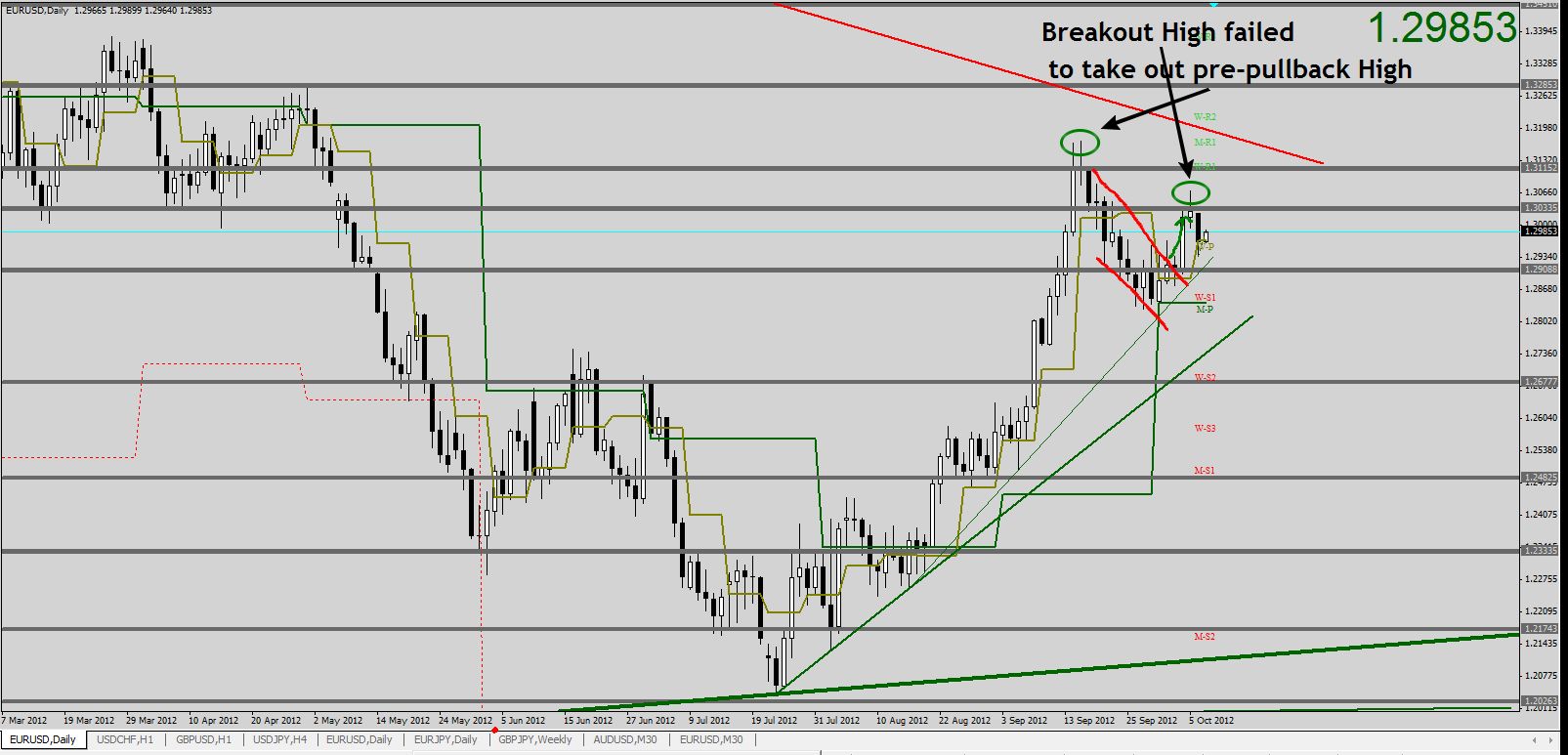

Despite the tumble since Friday, our Pivots are still in Bullish formation but in No Man’s Land, between our major S/R levels of 1.29088 & 1.30335, with little in the way of reliable Trendlines. Price Action is perched on Weekly Pivot and I’m seeing this as a nice bounce point for the Bulls. This level has seen plenty of recent action as Resistance and I’d expect it to return the favour and offer Support for EURO. I’m a little Bullish for these reasons and am keen to see how a full complement of traders will view the previous few sessions of Bear runs.

The Day Ahead

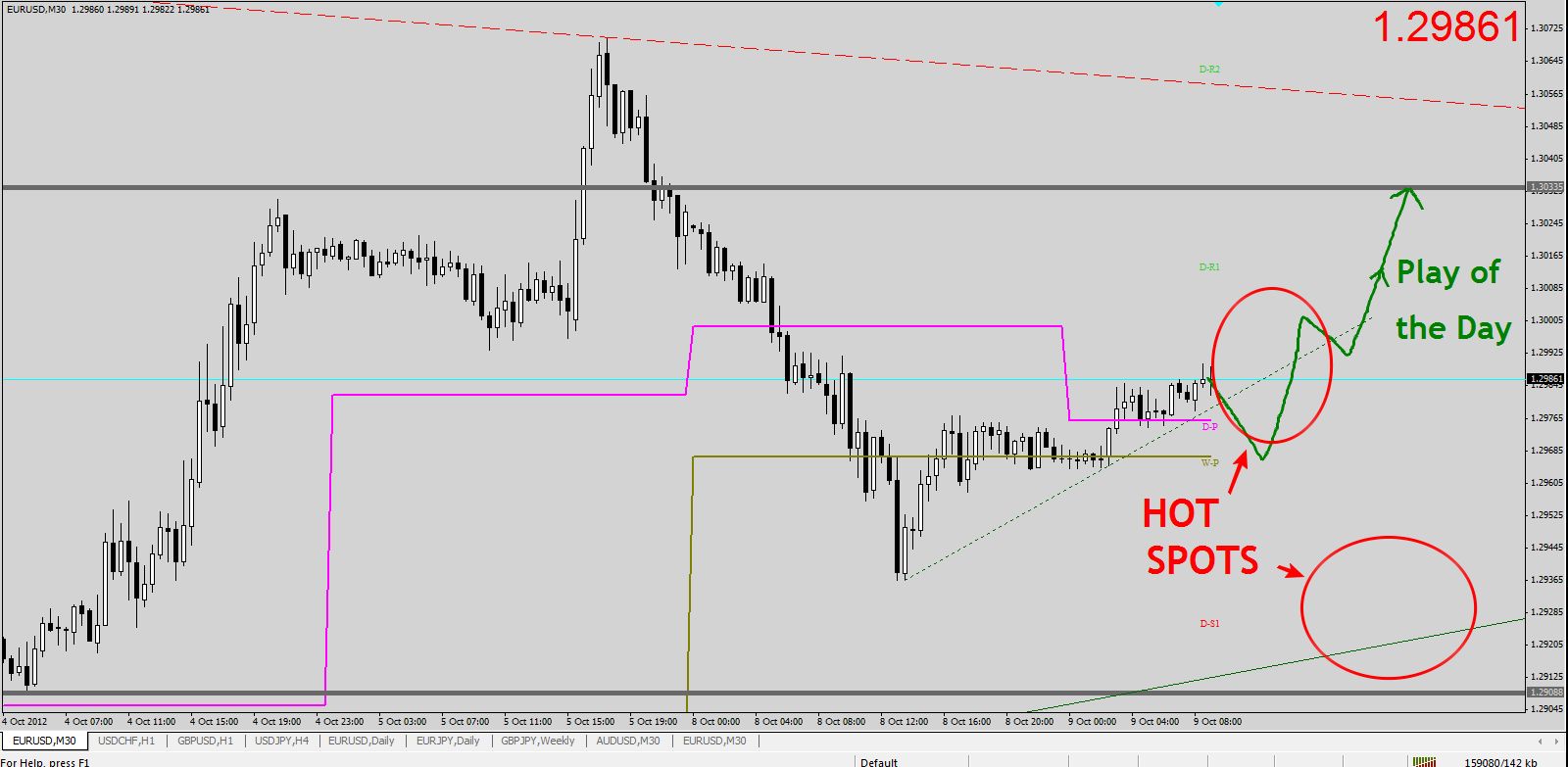

With sentiment in the Bulls corner, I am keen to find a reason to go Long. Currently, the best chance of that appears to be playing a false break of a provisional, Intraday Support Trendline. Should Price Action accommodate, I’d like a further Trendline to be formed but for now, only Plan A exists. Super Mario speaks shortly so might get some early action.

High Impact News

| 9:30am | EUR | ECB President Draghi Speaks |

Have a great trading week everyone.

Davide Franceschini | Chief Trader and Founder at SurfingThePips.com

No comments yet.