G’day Surfers – it’s 30-all & Draghi’s serve!

Yesterday’s Report

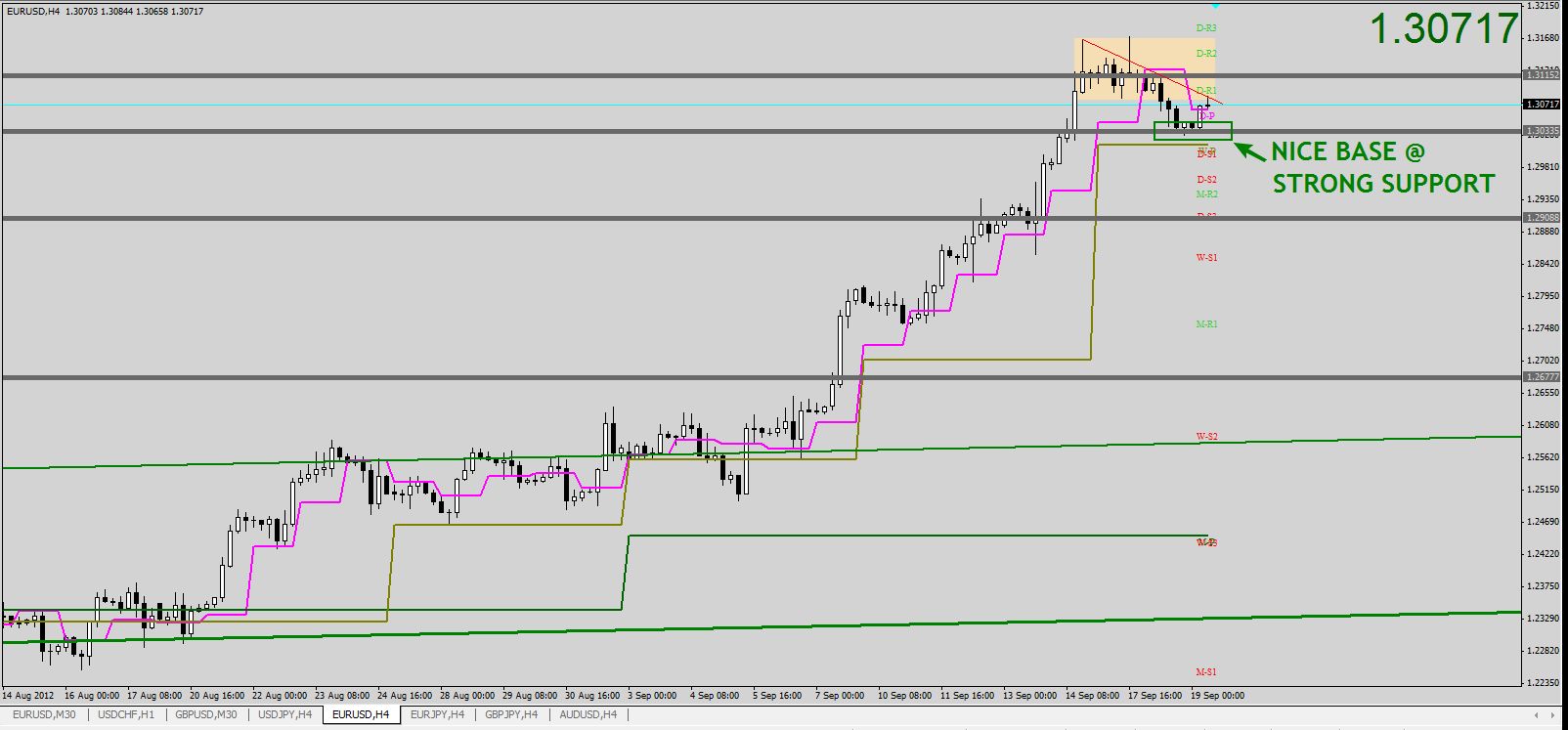

Monday’s expected pullback developed very slowly yesterday with Price Action meandering it’s way to a gentle bottom at, you guessed it, our oft tested S/R level of 1.3033. A nice base formed at that level after EURO had “corrected” by 70 pips over the day. We were enticed to take a Short entry a couple of hours into London session but the entry wasn’t up to specs, so we stayed flat. With the extreme “noise” of the choppy market, the entry would have produced a BE trade and we were happy to have adhered to our discipline.

Technical Analysis

The base @ 1.3033 was building nicely before reaction to BOJ’s decision to enhance Monetary Easing & leave the door open to expand on that, assisted in sending EUR/USD directly to the recently rejected Daily Pivot, providing the first test since last Thursday! I’m still getting mixed signals with the presence of the double top but with Price Action now above Daily Pivot which leads Weekly & Monthly (as distant as it is) in Total Bullish formation, it’s hard NOT to favour Longs. We have both a Support & Resistance Trendline to play with – the once broken Resistance Trendline has caused Price Action to pause after it’s 50 pip run through Asia Session. Perhaps early London Trading will create something more.

The Day Ahead

With EURO perched above DP in a very strong Bullish Trend, it will take a VERY good setup to get me Short. I hope Asian session hasn’t knocked the wind out of EURO’s sails however. As I said, I have a Resistance line to play with & an Intradsy Support line. I need market to pullback (maybe to DP) so an attack can be launched at the Hotspot. As I write this, that is happening!

High Impact News

| 2:30pm | USD | Building Permits |

| 4:00pm | USD | Existing Home Sales |

Have a great day

Geoff Pyne | Certified SurfingThePips.com Trader

No comments yet.